I have been thinking about one of the biggest mental blocks financially: shift from accumulation to distribution. The mindset shifts from having predictable monthly income with growth goals to monthly drawdown from savings. I plan to have some passive income but it’s hardly enough to cover all the expected expenses from retirement with health insurance, education, and planned lifestyle inflation with extra vacations and other fun activities.

Challenges and opportunities

- Enable our best selves. I plan for intentional “lifestyle inflation” when I shift to retirement. Whether it is new hobbies, more traveling, or renewing connections with old friends, I want to find new purpose, new meaning, reestablish old friendships, and build new communities. Having more “play” money for discretionary spending is highly desirable.

- Assume longevity. Conservative assumptions make for a better plan. It’s also backed up by research “The life expectancy of Asian Americans has steadily improved since 2001 to an average of 84.0—the highest life expectancy of all the "Americas." from “Eight Americas: Investigating Mortality Disparities across Races, Counties, and Race-Counties in the United States”

- Concentrated investments. As we have been working in tech for so many years, our family has uncomfortably concentrated positions in a few tech stocks. This happened as part of our employee stock purchase plans and just a greater sense of knowledge to invest in what we understand.

- Optimize for gap years. I plan to have 2 phases of gap years. First phase with early retirement before I withdraw from my pre-tax retirement account tax penalty free at 59 ½. Second phase is from the start of withdrawal from pre-tax retirement accounts to the required minimum distribution (RMD) at 73. Each of these phases requires a different tax strategy to optimize for long term money preservation.

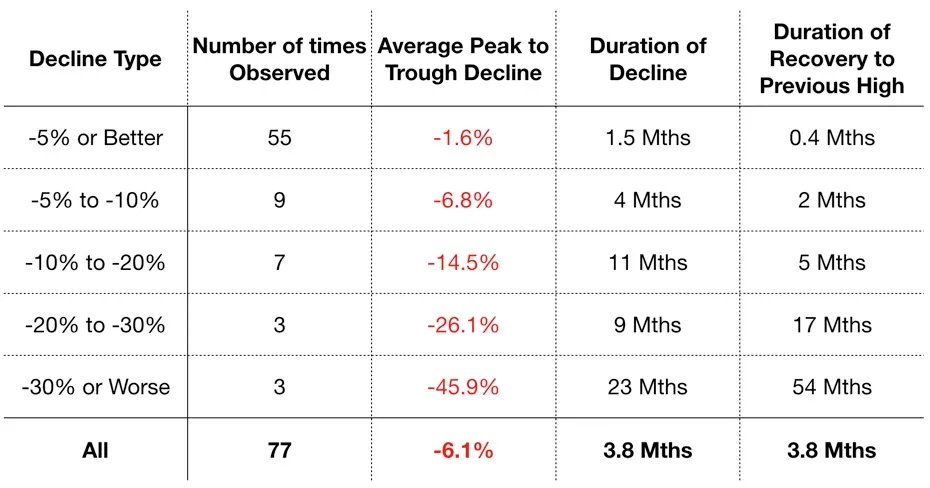

With all these challenges, I don’t believe the traditional 4% withdrawal rule will work for me. Neither is 60/40 stock to bond portfolios. I plan to adopt a variation of the dynamic bucket strategy. The basis of my plan are primarily from these 2 articles: “Dynamic Retirement Withdrawals?” and “The Anatomy of a Stock Market Downturn”. Both articles and authors are worth your time. The key insight is from this chart.

With 1 year of expenses, I can handle 10% loss and more than 80% of the historical market downturn cycles. With 4 years worth of expenses, I can handle a 30% loss and more than 95% of the historical market downturn cycles. My goal is to have 25 years worth of expenses when I retire. With 5 years of expenses (20%) as guardrail, I can take more risks on the remaining 20 years of investments.

The shape of my dynamic retirement withdrawal strategy

- Bucket based on expected volatility and return: none (2% return), low (4% return), and medium (6% return)

- Bucket size based on years of living expense : 1 year, 4 year, and the rest

- Regular fixed amount drawdown for dollar-cost averaging of stock sales

- Start with the biggest bucket and funds with the highest percentage of investment dollars.

- Sell funds that exceeds target return

- Rebalance and fill smaller buckets annually

With this strategy, I will

- Keep most of my investments in stock

- Tax efficiently divest from concentrated investments

- Protect from all but the most severe market downturns

- Comfortably spend more in early retirement

This is a complicated strategy and that is a big problem. At the same time, I’m confident that I can write a Google sheet script that tells me which and how much stock to sell every month. I can do what-if analysis of alternative strategies to pressure test this method. I can also create another script to make a rebalance allocation recommendation every year. The script should take most of the emotion out of the decision making process. In turn, smooth out the mental transition from accumulation to distribution.

No comments:

Post a Comment