For the 7 or 8 people that have been reading this blog regularly (small but growing.. thank you!) Here are some rhetorical questions for you. :)

- Do I know the importance of credit score?

- Do I track my credit score?

- Do I understand how credit score works?

- Do I have an excellent credit score?

- Do I make financial decisions due to or risk of change to my credit score?

Yes to all questions, except the last and that is probably a bit counter-intuitive. If I don’t make financial decisions from credit score why bother with all the work to understand, track, and review credit score. For context, I worked in the financial industry for a period of time. We used the FICO score as a key signal for credit card approval decisions. I’m familiar with historical calculation, usage, data sources, and business purposes of the score. However, when I switch hats to personal finance, credit score has a very limited use.

What is a credit score and how does it work?

There are a few versions of credit score from a few different companies, but they all serve the same purpose. The score uses various factors to predict the likelihood of the applicant paying back a loan. The key factors used are on time payment history, years of credit history, percent of credit used, number of accounts, recency of new accounts, number of loan application requests, etc. There are some complicated formulas that are always being adjusted to give a single score ranging from poor to excellent credit risk. The actual number doesn’t have any meaning but higher the score means there is lower risk of the applicant not paying back the loan (defaulting on the loan is the term used in the lending industry. Perhaps an insider joke, the natural state of a loan is an "default"?).

By corollary, it also means a high score loan applicant is a more competitive customer with more choices of lenders. A lender would likely need to offer a better interest rate to acquire the high score customer. Getting a good interest rate is the best reason to maintain a good credit score. I can potentially save thousands of dollars with a great rate on home and auto loans. The other reason to maintain a good credit score is fraud prevention. The expensive and subtle financial fraud committed using stolen identity is hard to catch, and protecting one’s credit score is the best way to prevent and limit the damage. Given there are 2 good reasons to establish a good credit score (save money, prevent fraud), then why don't I believe in credit score but still do all the work to track it?

Why is a credit score bad as a goal?

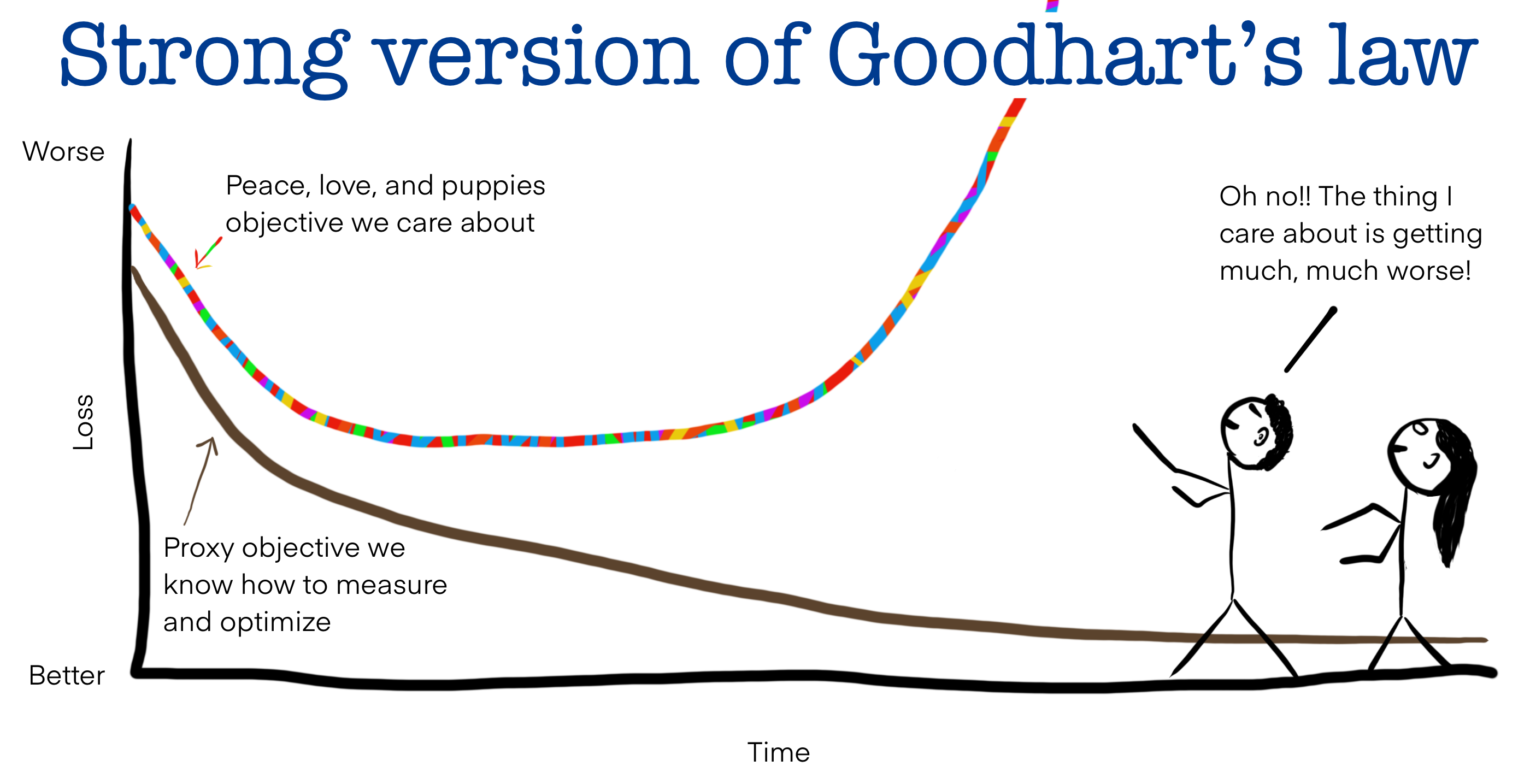

Perhaps you have heard of Goodhart's Law (wikipedia) ? It states that "When a measure becomes a target, it ceases to be a good measure". This law beautifully summarized my problem with credit score and using it as a goal.

I want to share a recent personal example. A few months ago, my auto lease was about to end. I applied for auto loans from many different lenders. I believe that getting an auto loan will significantly increase the percentage of credit used and quite negatively change my credit score. When I applied, the first lender gave me a fair market rate. I could have stopped the search. The more lenders that I ask, the more it’s going to hurt my credit score for a period of time. I ended up applying to 4 to 6 different lenders and gotten a great rate.

The big picture is that getting a loan at a great rate helps protect my cash reserve, and gives me control and flexibility on when I want to pay back the loan. For a small increase in my monthly expenses and I can keep my cash reserve in high earning money market rate. The actual cash flow change is a only a small loss. These are much more important factors to the health of my finances than the credit score. If I let the credit score measure become a target then I would have paid for the car with my cash reserve or leased another car. I wouldn’t have shopped around and took the first fair market loan rate.

The takeaway

If you are in the early stage of your personal finance journey, or recovering from a setback, then yes, improving your credit score is a fine target. As fraud prevention, it's very important to continuously monitor and protect it. However, once you have achieved a good credit score (about the middle of the pack), any target to improve it is unlikely to have much impact and prevents you from achieving higher and more important financial goals like retirement. In my experience, as long as you are following best practices in personal finance, a good credit score will happen naturally. It’s not a useful or meaningful goal to set. Similar to my principles on budgeting, it only leads to micromanaging and causes more distraction than is useful in real life practice.

No comments:

Post a Comment